Blogs

January 21, 2021

China's housing market bounces back from pandemic

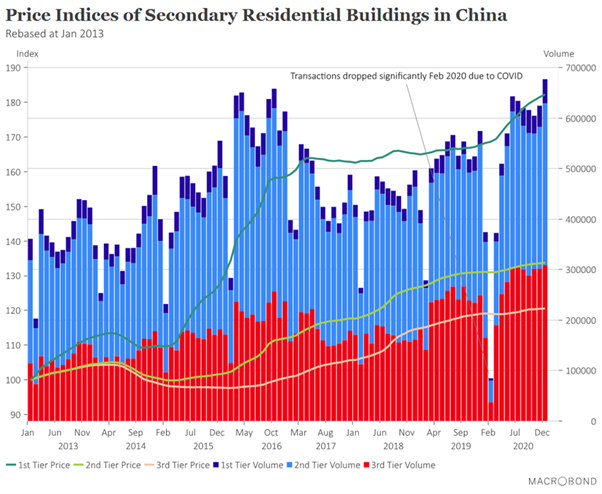

Our chart shows the resilience of Chinese property in the secondary market.

In-house blogger

Guest blogger

Laraine Yuan

,

International Account Manager - APAC

Macrobond

All opinions expressed in this content are those of the contributor(s) and do not reflect the views of Macrobond Financial AB.

All written and electronic communication from Macrobond Financial AB is for information or marketing purposes and does not qualify as substantive research.

Editor:

As our chart shows, sales of homes in China’s secondary market shot right back up just one month after plummeting in response to the COVID-19 crisis. Not only that, but volumes have since continued to climb – along with prices! This is especially true for residences in the most urbanised and economically developed areas – so-called tier-1 cities such as Beijing, Shanghai, Guangzhou and Shenzhen.

Property analysts say Chinese investors view housing as a safer bet than stock markets or overseas assets. As the pandemic threatens a global economic downturn, can we expect demand to intensify? And how much more can prices rise before the bubble finally bursts?